ri tax rate income

51 rows If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. DO NOT use to figure your Rhode Island tax.

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value.

. Rhode Island also has a 700 percent corporate income tax rate. In 2011 Rhode Islands tax system underwent the most sweeping changes since the state tax was enacted in 1971. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T.

An individuals tax liability varies according to his or her tax bracket. The range where your annual income. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T.

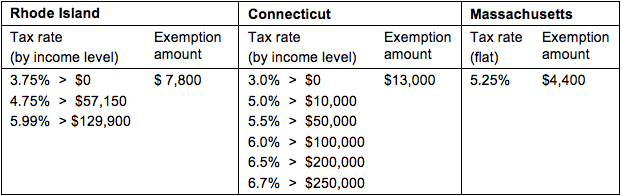

Levels of taxable income. The income tax is progressive tax with rates ranging from 375 up to. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

Rhode Island utilized a personal income tax rate ranging from 375 percent to 599 percent in 2017. Levels of taxable income. Each tax bracket corresponds to an income range.

Interest on overpayments for the. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. It is one of the few states to tax Social Security retirement benefits though there are some stipulations.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. DO NOT use to figure your Rhode Island tax.

Residents and nonresidents including resident and. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. For the 2022 tax year homeowners.

This page has the latest Rhode. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. A tax bracket is the.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. 3 rows Rhode Island state income tax rate table for the 2022 - 2023 filing season has three. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023.

Compare your take home after tax and estimate. Any income over 150550 would be. Rhode Island taxes most retirement income at rates ranging from 375 to 599.

Most notable was the reduction of. 2023 Rhode Island Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Compare your take home after tax and estimate.

Rhode Islands 2022 income tax ranges from 375 to 599. Personal income tax. The rate so set will be in effect for the calendar year 2021.

2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

Rhode Island has a. Rhode Island Property Tax Breaks for Retirees. Rhode Island Tax Brackets for Tax Year 2021.

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Greater Providence Chamber Of Commerce Our Top 10 Reasons Why Now S Not The Time For A 50 Tax Hike On Rhode Islanders Any Increase In Personal Income Tax Rates Would Adversely

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

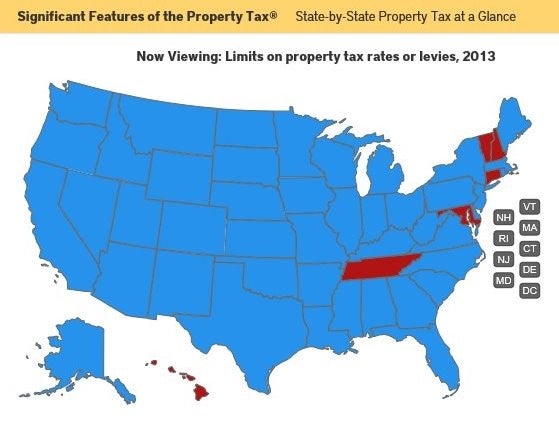

New Online Resource State By State Property Tax At A Glance Lincoln Institute Of Land Policy

Revenue For Ri Kicks Off Campaign To Tax The One Percent

Progressive Charlestown Taxing History

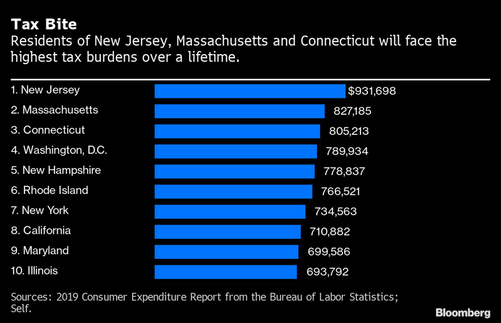

New Jersey Taxes Newjerseyalmanac Com

The Individual State Income Tax Rate For Every State For 2016 Chart Atlanta Business Chronicle

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Rhode Island Income Tax Calculator Smartasset

Do Citizens Vote With Their Feet How Taxes Affect Where People Choose To Live

Seven Things To Know About The R I House Finance Budget The Boston Globe

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map