how much does illinois tax on paychecks

Nevada has the 13th highest combined average state and local sales tax rate in the US according to the Tax Foundation. Some people get monthly paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year.

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Palos Park Il 60 Certified Public Accountant Naperville Solutions

New Jersey payroll taxes include State Unemployment Insurance SUI and State Disability Insurance SDI.

. For 2018 these limits total 23759 with SUI accounting for 17356 and SDI at 6403. Unlike federal or state income taxes there are annual limits on the amount of SUISDI tax an employee must pay. Second find out how much you owe for all the children with the other.

Nevada is one of the seven states with no income tax so the income tax rates regardless of how much you make are 0 percentBut the state makes up for this with a higher-than-average sales tax. It is levied by the Internal Service Revenue IRS in order to raise revenue for the US. Nevada State Personal Income Tax.

For example if you live in Illinois and work in another state with which it has a reciprocal agreement your employer might mistakenly withhold tax for the state where you work from your paycheck. Split care is when you have more than one child but do not have physical care of all of them. The guidelines for determining support are the same.

You will have to do 2 calculations instead of one. Unemployment Insurance If you are laid off you can. While individual income is only one source of revenue for the IRS out of a handful such as income tax on corporations payroll tax and estate tax.

The more paychecks you get each year the smaller each paycheck is assuming the same salary. In that case you would have to file a tax return from your employers state to get that money back. At the end of the year every person that earned income must file a tax return to determine whether the government collected enough taxes through withholding or whether the government owes a person a refund for paying too much tax.

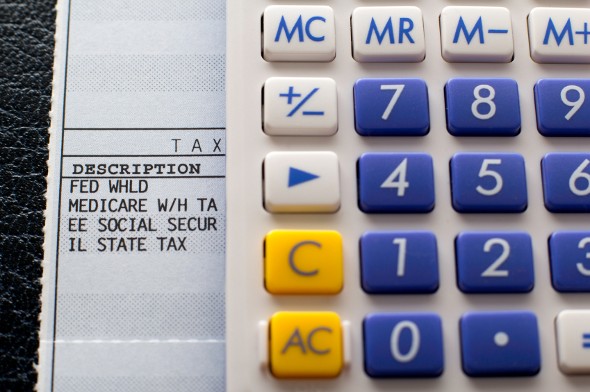

Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. First find out how much you are owed for all the children living with you. The frequency of your paychecks will affect their size.

Federal income tax is usually the largest tax deduction from gross pay on a paycheck. The collection of income taxes occurs throughout the year by withholding money from a persons paychecks. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Illinois Income Tax Calculator Smartasset Federal Income Tax Capital Gains Tax Income Tax

Pin By Escaping Illinois On Escaping Illinois Illinois Something To Do Resources

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Why The Illinois Exodus The Rich Get Bashed And Off They Go Illinois Tribune The Neighbourhood

Dollars That Make Sense Updated Budgeting Budgeting Money Monthly Budget

Missouri Income Tax Rate And Brackets H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Understanding Payroll Taxes And Who Pays Them Smartasset

هذه هي شهادة التنقل الاستثنائية التي سيمنحها المقدم للمواطنين هوية بريس Soa Bha

How To Stay Debt Free Debt Solutions Debt Consolidation Companies Unsecured Credit Cards

Unemployment Rates Up In 387 Of 389 Metropolitan Areas From August 2019 To August 2020 Metropolitan Area World Map Employment

Synergistic Life Services Geoff Thompson On Slides Com Presenting Synergistic S Unique Strategies For Retirement Finance Blog Retirement Planning How To Plan

If You Re Curious About Printing Paychecks This Article Is For You Learn The Pros And Cons To Print Payroll Checks Payroll Checks Quickbooks Payroll Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

States That Won T Tax Your Retirement Distributions Retirement Retirement Income Tax

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Faslist Com Daily Blog Top 10 States For Lovers Top 10 Culture Pinterest Lovers Virginia And Funny Farm